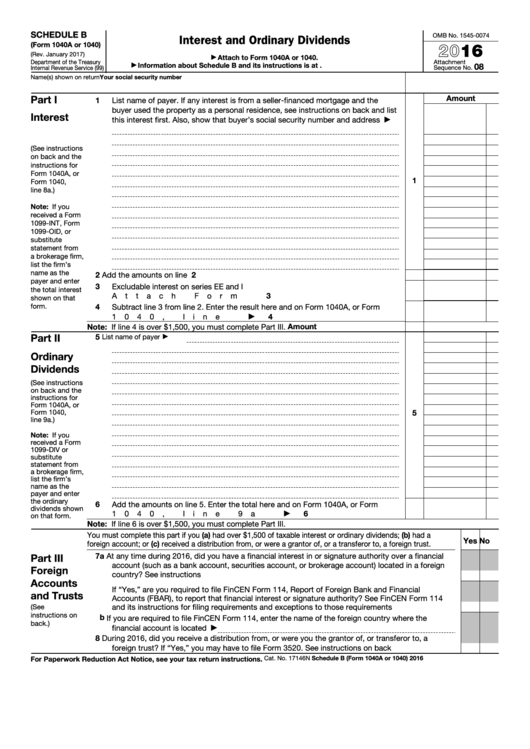

You had more than $1,500 of taxable interest or ordinary dividends.

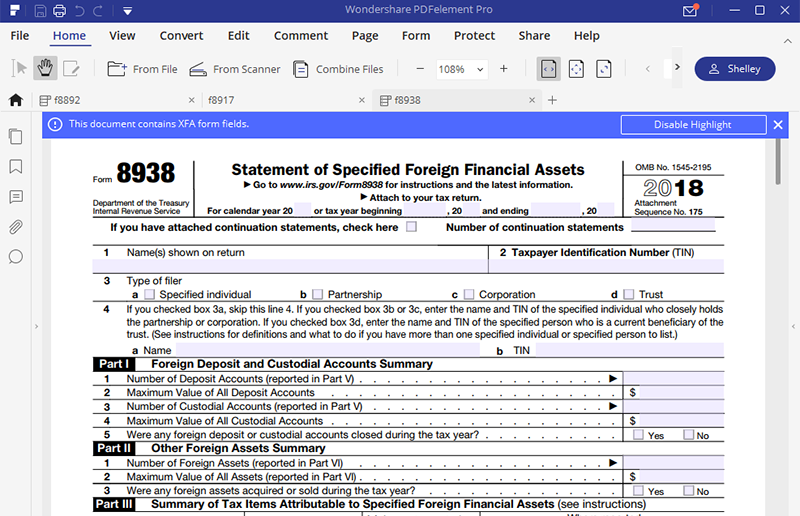

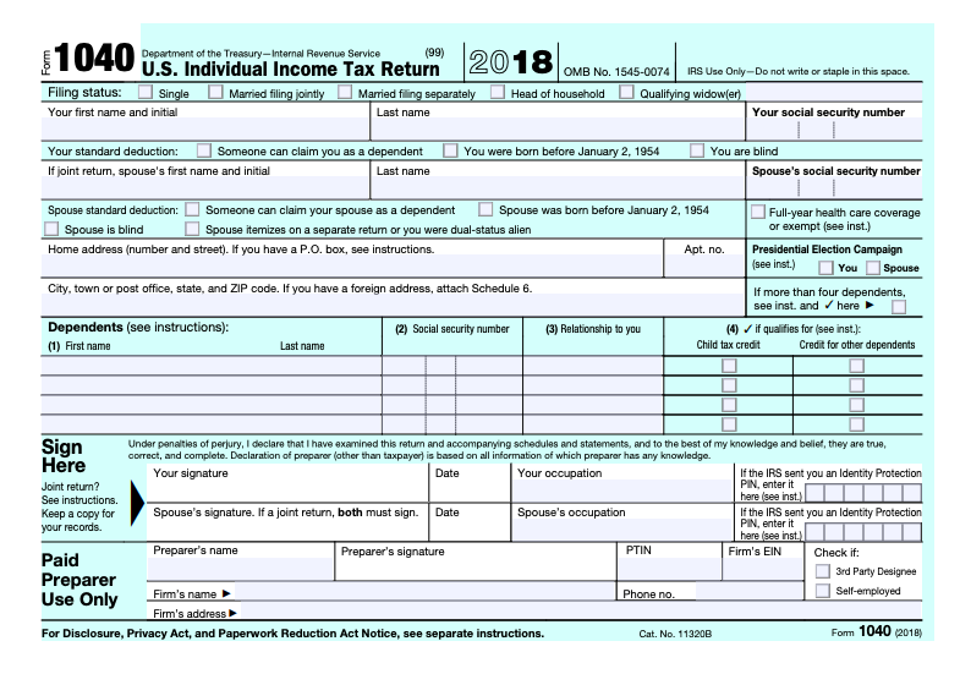

When would you use Schedule B? According to the Internal Revenue Service, here are the situations when you'd need to use this schedule: If you paid taxes on this income in the country they are located, you may get a credit toward your federal taxes. If this is the case, you may have to fill out additional forms related to foreign income. You also must use Schedule B if you had a foreign account, or received a distribution from, were a grantor of, or a transferer to, a foreign trust. The 1040 Schedule B captures and breaks out these different income sources and totals, so you are taxed at the proper rate for that kinds of income. For example, interest income, such as from bonds, CDs, and savings accounts, is taxed at your marginal rate, while dividends are taxed as long-term gains, which is either 15% or 20%, depending on your total earnings. One of the reasons why is that these types of income are often subject to different taxes than earnings from your job. The primary purpose of the 1040 Schedule B is to report income from interest, ordinary dividends, and foreign accounts. This would be on top of your regular earnings from your employer, or business, if self-employed. Income from multiple sources As time passes, your sources of income can start to vary, including dividends, interest from bonds, real estate. Let's take a closer look at the situations where you'll use Schedule B, and explain why it matters. In order to help determine what your tax is, many filers will need to use Form 1040 Schedule B. Ben Franklinįor investors, the taxes part can get complex, depending on how you generate income during the course of the year. In this world nothing can be said to be certain, except death and taxes.

0 kommentar(er)

0 kommentar(er)